Policy and Resources' 2025 budget maintains that increasing income tax by 2% over two years would stabilise the island's financial position.

The 2025 budget is a radical departure in that it tinkers with income tax.

For decades it has been 20% but Guernsey's senior committee has proposed a 22% rate, over two years, to tackle a debt that will total around £43M when everything is factored in.

Previous attempts to stem losses with GST failed, and led to the Assembly voting out the previous P&R.

The 22% rate would generate an extra £34M in revenue in both 2025 and 2026.

If approved, personal tax allowances would also increase by £1,100.

This would mean islanders would pay tax on earnings above £15,000.

Head of Policy and Resources, deputy Lyndon Trott, says this would protect lower income households:

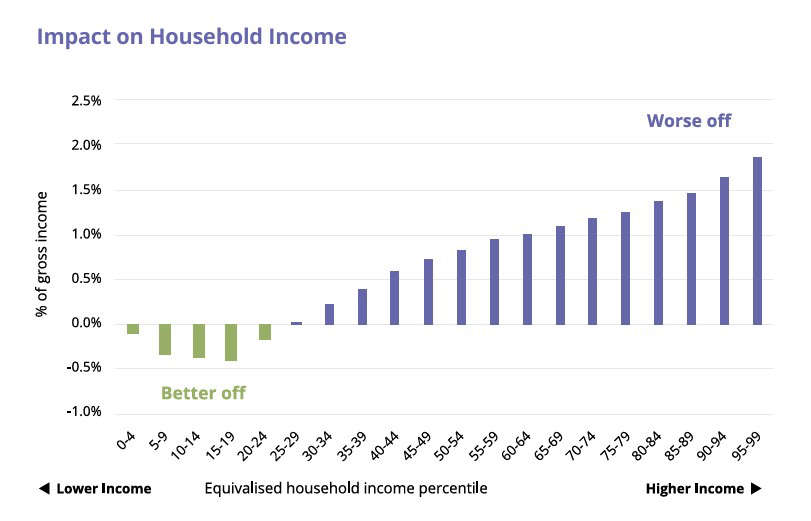

"Those of us who are fortunate enough to earn a little bit more, and that does include me, will probably end up paying about one and a half percent more on our income.

"Whereas those that require the most protection will end up paying nothing more."

P&R's proposals would also see a freeze on alcohol duty and an inflationary rise only in fuel duty.

Deputy Trott says they have purposely avoided changing multiple taxes in this budget.

"People are fed up with the so-called stealth taxes, the incessant rise in alcohol and petrol duty and in TRP.

"So we are not proposing any real term rises in that regard, and concentrating in fact on what we believe is the fairest type of tax, and that is tax on income."

However, the Policy and Resources Committee is recommending a 13.2% increase in duty on all tobacco products.

Deputies will debate the budget in November.

Replica Liberation Day medals will be gifted to Guernsey children

Replica Liberation Day medals will be gifted to Guernsey children

Guernsey sends £50,000 to those affected by Myanmar's earthquake

Guernsey sends £50,000 to those affected by Myanmar's earthquake

Guernsey PC earns three top accolades for saving a life

Guernsey PC earns three top accolades for saving a life

Children’s Zone planned for Guernsey's 80th Liberation Day

Children’s Zone planned for Guernsey's 80th Liberation Day

100 days until Orkney Island Games begin

100 days until Orkney Island Games begin

Guernsey hospitality chain buys The Duke of Richmond Hotel

Guernsey hospitality chain buys The Duke of Richmond Hotel

European visitors now need permit for UK entry

European visitors now need permit for UK entry

Designers chosen for new Guernsey banknotes

Designers chosen for new Guernsey banknotes