The States Assembly will be asked to spend and borrow big when the 2022 to 2025 Government Plan is debated later this year.

Last year's plan included borrowing £336 million to deal with the impact of Covid-19.

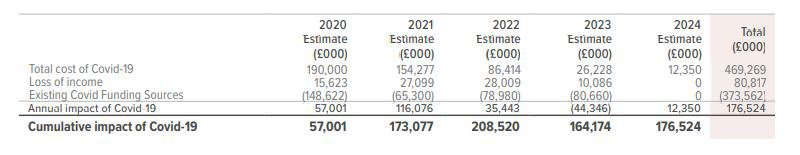

The overall cost of the pandemic in 2020 was £190million, with up to an extra £280 million forecast and held as contingency between 2021 and 2024.

The government says the net impact of the pandemic between 2020 and 2025, including the recovery, is now estimated at £177 million, with a peak of £208 million in 2022.

The debt will eventually be covered by the expected £345 million in additional tax receipts over the next two decades from moving all taxpayers to Current-Year-Basis.

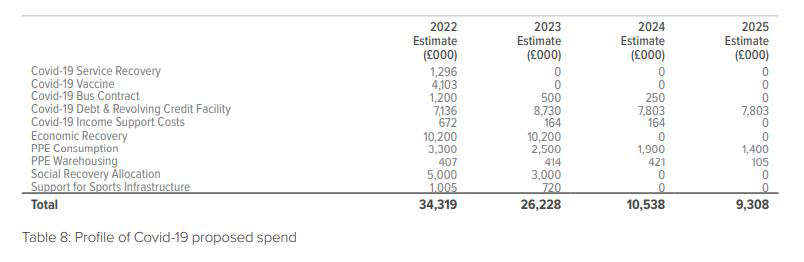

"The relevant expenditure in the period of this Government Plan covers vaccination and Test and Tracing, but also makes provision for funding of measures to support Islanders and businesses. These are anticipated to be largely ended by 2024.

The costs of the pandemic have been in part offset through the use of the Stabilisation Fund and removal of grants to the Social Security Fund from 2020 to 2023. This plan continues to propose meeting the impact on Government finances through borrowing (up to £209 million based on peak impact – far less than that approved by the Assembly in last year’s Government Plan).

"However the Government will continue to seek to minimise this debt, utilising forecast surpluses in the later years of the plan. If income is higher or costs are lower than anticipated then this will also reduce the requirement. The plan also proposes the refinancing of the Rolling Credit Facility with a longer-term solution, using Prior-Year Basis income tax receipts to eventually repay the debt.

"In addition to these impacts, the States Assembly agreed an additional £50m of borrowing to establish the Fiscal Stimulus fund (in P.128/2020) At this time, the Minister for Treasury & Resources has approved for funding of £29.6 million for eligible projects. There is an intention to retain the ability to borrow a further £20 million, to provide flexibility for the remainder of the plan, although it is anticipated that these funds will not be a necessary part of the economic recovery measures in 2022."

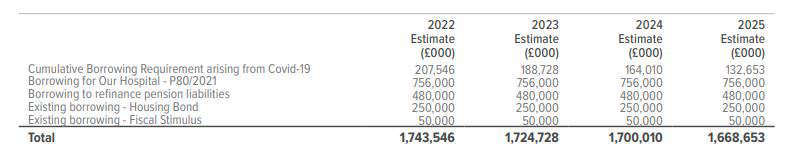

It's estimated that the amount that needs to be borrowed to meet Covid-19 costs will reduce in subsequent years of the plan, ending at £133million in 2025.

The plan also sets out to borrow £756 million for the new hospital project, and a proposal to refinance pension liabilities to pay back the debt more quickly - saving £3.6 billion (£700m in real terms)

Ministers warn that the Government Plan will need to be amended, should the proposition to borrow £756 million be defeated next month.

"The borrowing proposed in this plan relates to refinancing, replacing existing liabilities. This increases the amount of total approved borrowing, but this is offset by the cancellation of the past service liabilities meaning that total non-current liabilities are not increased.

"The Government Plan approves the total amount of borrowing required – actual borrowing may be raised over several years in line with the debt strategy and depending on cash-flow requirements. This plan recognises that all borrowing must eventually be paid for and includes a strategy for the repayment for each item of borrowing, ensuring that these repayments are affordable and sustainable."

£34 million has been budgeted for 2022 for direct Covid-19 response costs and to support the post-pandemic recovery.

An additional £53 million would be held in reserve, including £20 million for the track and trace programme.

This plan proposes spending a total of £1.118 billion in 2022. £962 million would be on public services and £217 million would be on projects such as the new hospital.

That £1.118billion compares to £955 million in 2020.

"This increase is largely driven by the inclusion of Our Hospital and the projected costs relating to the pandemic response and economic recovery."

The plan is to return to a balanced budget by 2023.

To do that, the government is proposing to save £20 million a year in 2022, 2023, and 2024 (£21.7mill planned for 2022) and raise £10 million through taxation by 2024, to include:

- Taxing the growing and processing of medicinal cannabis

- Broadening the tax base of corporate taxation

- Reviewing commercial stamp duty levels and residential stamp duty

- Requiring offshore retailers to register for GST and reducing the GST de minimus to £60 from 1 January 2023

The government will also receive £40 million from the sale of the JT 'Internet of Things' business, with £20 million of that earmarked for a Technology Fund.

"These measures maintain surpluses from 2024, help fund key projects and reduce the long-term debt required arising from Covid-19. The response to Covid-19 does require us to borrow to meet the expenditure and this plan has assumed that this will be capped at £209 million based on the forecast total net cost of addressing the issues arising from Covid-19 from 2020-2024.

"The planning assumption is that there will not be significant additional expenditure required (other than that provided for) as a result of future waves of Covid-19 and the estimates contained in this plan focus on bringing about economic recovery and an investment in core services to address social issues and service backlogs arising from Covid-19."

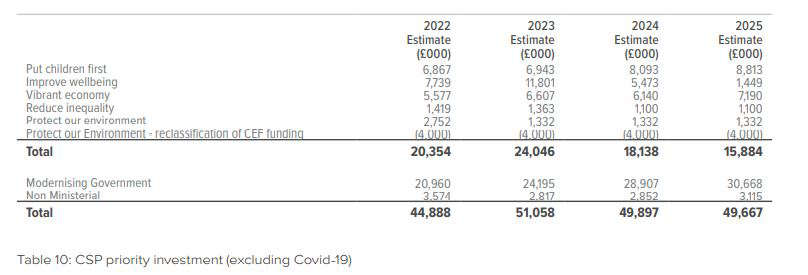

£45 million is set aside to fund the government's strategic priorities - such as putting children first, reducing inequality, and improving wellbeing.

These amounts are over and above the £121 million per annum investment previously agreed for 2020 and 2021. Amounts in respect of “Protect our environment” are in addition to investment provided through the Climate Emergency Fund (CEF) – with transfers now increasing to £4.4 million in 2022."

Putting Children First

- More support services targeted at young people

- Progress results of the review into the North of St Helier school

- More resources to stop increasing education pressures

Improving islanders' wellbeing and mental and physical health

- Health & Social Recovery Fund to support Covid-19 recovery - e.g. children's dental health, Long Covid, free nursery places, closing gaps caused by Covid-19 disruption.

- Continuing to fund the coronavirus helpline

- Continuing to fund the test and trace programme

- Children's health recovery plan

- Health service recovery

- Funding the Covid-19 vaccine booster campaign

- Funding to supply and continue to store and distribute PPE

- Funding to address the gap between the increasing demand on obstetric & gynecological services and the capacity to delivering care at the point of need, which includes more consultant presence on the labour ward

- Replacing ambulance and fire and rescue vehicles

- Developing a proof of concept for a specialist paramedic team to respond to less critical calls and treat patients on-site to help improve waiting times and reduce the number of patients transported to hospital

Vibrant Economy

- More money to make sure Jersey's corporate tax system is fair, provides for the island's needs, aligns with international standards, and supports the island in the long-term

- More money to make sure Jersey's financial crime regulatory regime meets international standards

- More money to support the new border control requirements in line with the TCA and to inspect all vehicles under the Vienna Convention to allow Jersey motorists to go into Europe after Brexit

- More money to complete development work at Elizabeth Castle

- Develop the detailed implementation for the new Student Protect our Finance Scheme that comes into effect from the autumn term 2023.

Reduce inequality

- Funding on housing and food licencing

- Funding on the income and expenditure survey, which is restarting after Covid-19 led to the cancellation of the last attempt.

- Funding to review workers' rights and provide a publicity campaign to make sure the law protects workers

- Work towards implementing new approach to support workers with long-term health conditions to return or stay in work

Protect our environment

- £4.5million to support new climate funds in 2022 that promote a faster transition to low carbon travel and introducing more energy efficient heating and cooling systems

- A new blueprint for the sustainable transport system - plans to overhaul the public bus system and developing a new network of walking and cycling routes

- More funding to invest in the public realm

- More funding to improve the long-term resilience of the pumping station network and protect against spills or pollution events

- Support the effective disposal and processing of all hazardous waste

- Fund the management of Jersey's fisheries and marine resources

- Fund the cost pressures with increased recycling

- Fund the trial and testing of a new way to dispose of glass

Modernising government

- Align jersey with the UK to create a more level playing field on GST between goods sold on the high street and those imported

- Insurance premiums increase and inflation

- Make sure the Jersey Field Squadron is financially stable over this government plan

- Fund two workers as part of the Brexit transition

- Give additional funding to the Jersey Police Authority

- Pay for maintaining the communications network to all emergency services

- Pay for more resources for Revenue Jersey

- Funding for the Regulation Directorate teams

- Financial solution to build the new hospital

- Continue funding the Integrated Technology Solution project

Non-Ministerial

- Funding to mark the Queen's Platinum Jubilee

- Funding to celebrate the 77th anniversary of Liberation Day

- More funding to implement the SEB decision to align the pay of the Bailiff and Deputy Bailiff with UK standards

- Four new States Greffe jobs

- More funding for the States pensions scheme

- Funding to redevelop the States Assembly website

- Funding for the States Greffe to host a British-Irish Parliamentary Assembly

- A temporary post to the States Greffe senior leadership team, given the heavy workload caused by the 2022 election

- Funds to cover the cost of the elections

- Funding to create a new Family Court Centre, to better meet the needs of children and families involved in Family Law proceedings

- Funding to manage info held electronically to deal with increase in number of FOI requests

- Pay increase for magistrates

- More money to operate the new Legal Aid Scheme

- Money on investigating and prosecuting financial crime

- More money for the Comptroller and Auditor General budget to cover additional costs and contractual inflation

- Funding to inspect the Probation Service

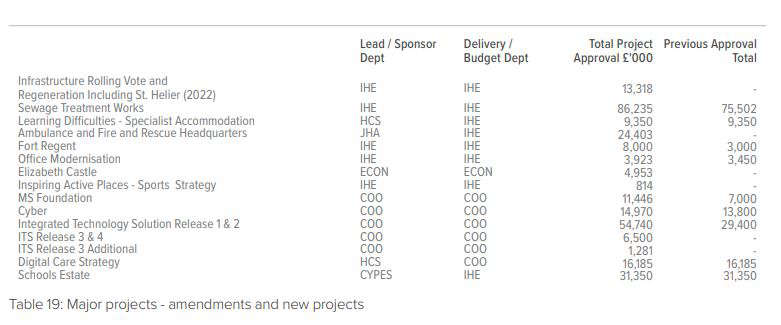

Funding has been set aside for a host of major projects in this plan - including on Fort Regent, Elizabeth Castle, and the schools estate.

Budget proposals include:

- No duty increase for beer and cider

- 8p duty increase on a 750ml bottle of wine

- 85p duty increase on a litre of spirits

- 65p duty increase on a packet of 20 king size cigs

- £3.55 duty increase on a 50g tobacco pouch

- 5pincrease per litre on road fuel duty, with 3p going into the Climate Emergency Fund

- VED going up from between 2.5% and 70.8%

- £550 increase in single person's tax exemption threshold

- £850 increase for a married couple

- £250 increase in second earners allowance

If the plan is approved, Andium rents will be frozen to help tenants while the economy is still recovering from the impact of the coronavirus pandemic.

The annual increase was deferred this year.

The 1% increase for local arts, heritage and culture is included and there is another increase to Jersey Overseas Aid's contributions.

The States Grant would be restored from 2024 onwards.

"This action enables an additional estimated £160 million to be allocated to urgent financial pressures. This is a critical element in enabling the Government to cope with the lost income and additional costs associated with Covid-19 and fund its capital and revenue expenditure programmes. If we do not do this, borrowing will need to increase further over the period to fund expenditure plans."

This is the final government plan for this Ministerial team.

Chief Minister Senator John Le Fondre says it maintains their commitment to the priorities they set at the start of their term of office, and also focuses on the major challenges they are facing.

"This plan establishes the basis for a strong financial legacy, with recurring savings of £54 million out of a target of £60 million. We will refinance past pension liabilities to save more than £3.6 billion and have moved from prior year (PYB) to current year (CYB) taxation, which will result in £345 million of additional receipts over the next 20 years.

"We are still counting the cost of Covid-19, and this plan addresses its impact on children through targeted youth support, on mental and physical health through a recovery programme, and on our economy through a new economic framework.

"Our vaccination programme has been one of the most successful in Europe, we have kept schools open more consistently than the UK and many European countries, and our investment in IT infrastructure set the foundation for the States Assembly becoming the first parliament in the Commonwealth to meet online.

"We are still committed to sustainable public finances and, through continued efficiencies and financial rebalancing, we are aiming to return to balanced budgets by 2023.

"The Plan’s careful stewardship of public finances will allow us to leave a legacy of financial stability and meaningful investment. As a Council of Ministers, we are committed to long-term planning; building foundations that will benefit not only Islanders living and working now, but the generations that will follow them. This Plan is a powerful step in achieving that end."

Jersey athlete, Lily McGarry, appeals for donations for prosthetic limbs

Jersey athlete, Lily McGarry, appeals for donations for prosthetic limbs

Levante Jet makes maiden voyage to Jersey

Levante Jet makes maiden voyage to Jersey

The split between working and non-working Jersey homeless is nearly 50/50

The split between working and non-working Jersey homeless is nearly 50/50

ArtHouse Jersey launches Liberation 80 exhibition

ArtHouse Jersey launches Liberation 80 exhibition

Carers offered free training sessions for dementia

Carers offered free training sessions for dementia

Philip's Footprints introduces new 'Seymour Stroll'

Philip's Footprints introduces new 'Seymour Stroll'

Firefighters save two islanders from serious St Peter car crash

Firefighters save two islanders from serious St Peter car crash

New Channel Islands catamaran tests well in choppy seas

New Channel Islands catamaran tests well in choppy seas