Jersey's parliament has passed changes to corporate taxation that will see large multinational companies pay 15% as part of a global crackdown on tax avoidance.

The OECD's Pillar Two framework is an worldwide initiative to establish a minimum 15% tax rate for multinational firms making more than 750 million euros annually.

Its adoption across jurisdictions is to stop companies moving their profits around to avoid paying tax on them.

Jersey's States Assembly has unanimously agreed the required measures.

It is estimated to affect around 1,400 Jersey-based companies, whose liabilities will increase from either zero or 10% under the new regime.

That will mean a windfall for the public purse. Ministers have said there is much uncertainly about the amount of additional revenue that will be generated, but previous estimates have put it at around £50m.

Last month, economic advisers the Fiscal Policy Panel recommended the extra income is used to rebuild reserves.

The changes will take effect from 2025.

"Jersey has a long-standing corporate income tax regime and Revenue Jersey is well resourced to deal with the roll out of Pillar 2. Over 95% of Jersey companies will be unaffected by this Pillar 2 legislation and will remain within the existing Jersey income tax regime."

The split between working and non-working Jersey homeless is nearly 50/50

The split between working and non-working Jersey homeless is nearly 50/50

Carers offered free training sessions for dementia

Carers offered free training sessions for dementia

Firefighters save two islanders from serious St Peter car crash

Firefighters save two islanders from serious St Peter car crash

New Channel Islands catamaran tests well in choppy seas

New Channel Islands catamaran tests well in choppy seas

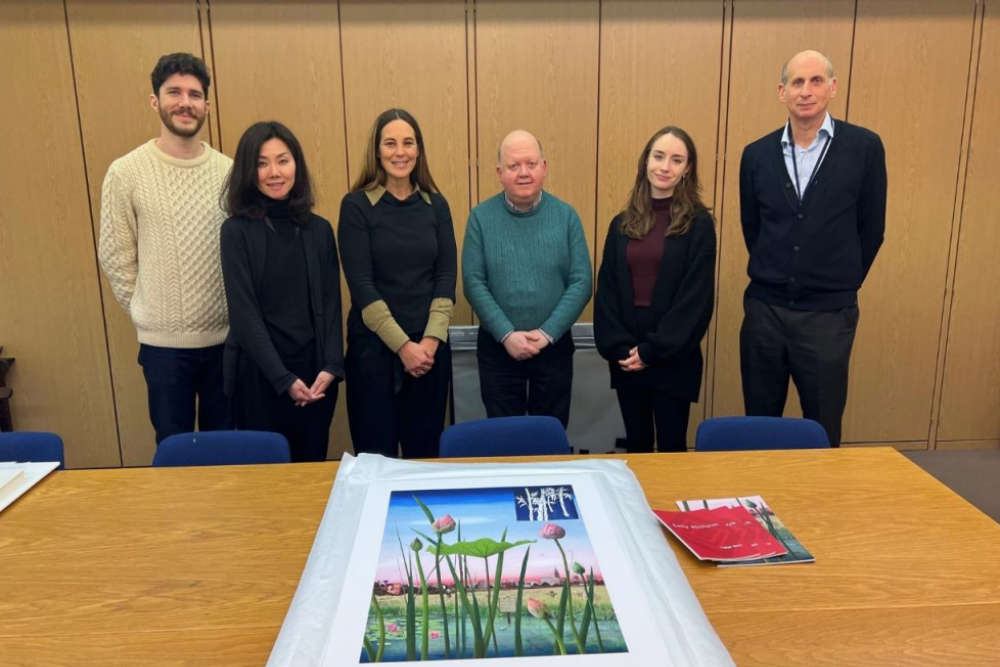

Jersey-born artist's work exhibited in the British Museum

Jersey-born artist's work exhibited in the British Museum

Jersey Hospice opens new chairty shop out east

Jersey Hospice opens new chairty shop out east

FIRST LOOK: New Parade Gardens playgrounds open two weeks early

FIRST LOOK: New Parade Gardens playgrounds open two weeks early

Bournemouth on the cards for 2026

Bournemouth on the cards for 2026