After weeks of campaigning, retail and close contact businesses are now eligible to apply to Jersey's co-funded payroll scheme.

They can claim wage subsidises for January 2022 from 5pm on Monday 7 February.

Driving schools, sports, and childcare businesses are also eligible.

"The CFPS is the most effective tool we have to respond to the impact that public health measures have had on businesses. When we brought back the scheme in December, we committed to keeping it under review to ensure it was able to provide support to all the sectors that were severely impacted, and this latest change shows we have done this.

It is intended that this is the final extension of the Scheme. The CFPS, together with other business support schemes, has protected the livelihoods of 15,000 Islanders throughout the pandemic. Now that public health measures have been withdrawn, we are entering a new phase of the pandemic and we look forward to a brighter year ahead, where the economy is able to operate free from restrictions." - Deputy Susie Pinel, Treasury Minister.

The scheme was reintroduced just before Christmas because of the Omicron Covid-19 variant, which led to masks being made mandatory again and work from home guidance being reintroduced.

Those restrictions were lifted earlier this week.

Restaurants and bars were among a host of sectors added to the scheme in mid-January, but the Chamber of Commerce argued for retailers and salons to be included too.

Economic Development Minister Senator Lyndon Farnham says he's pleased to be able to extend support to these sectors.

"Providing support throughout the pandemic has been essential to retain businesses and protect jobs."

The scheme was first introduced in April 2020 to protect businesses and jobs.

Those now eligible are:

- Other personal service activities not specified elsewhere

- Physical wellbeing activities

- Hairdressing and other beauty treatment

- Driving school activities

- Other human health activities

- Sports activities (including gyms)

- Sports and recreation education

- Cultural education

- Other education not elsewhere specified

- Child day care activities

- Pre-primary education

- Other retail sale not in stores, stalls or markets

- Retail sale of watches and jewellery in specialised stores

- Other retail in non-specialised stores

- Other retail sale of new goods in specialised

- Retail sale of clothing in specialised stores

- Retail sale of cosmetic and toilet articles in specialised stores

- Retail sale of cultural and recreation goods in specialised stores

- Retail sale of footwear and leather goods in specialised stores

- Retail sale of other household equipment in specialised stores

- Retail sale of second-hand goods in stores

- Retail sale via mail order houses or via Internet

- Wholesale of food, beverages and tobacco (where majority of sales to hospitality)

- Non-Specialist Wholesalers (where 75% of sales are tourism related)

The Chamber of Commerce has described the government's decision as 'a positive step.'

Pleased to hear following our survey & engagement with Ministers that the Co-Funded Payroll Scheme has been extended to include retail & close contact service businesses. A positive step for those businesses affected during the latest covid restrictions.https://t.co/WnLZOdAZCD

— Jersey Chamber (@jerseychamber) February 2, 2022

The split between working and non-working Jersey homeless is nearly 50/50

The split between working and non-working Jersey homeless is nearly 50/50

Carers offered free training sessions for dementia

Carers offered free training sessions for dementia

Firefighters save two islanders from serious St Peter car crash

Firefighters save two islanders from serious St Peter car crash

New Channel Islands catamaran tests well in choppy seas

New Channel Islands catamaran tests well in choppy seas

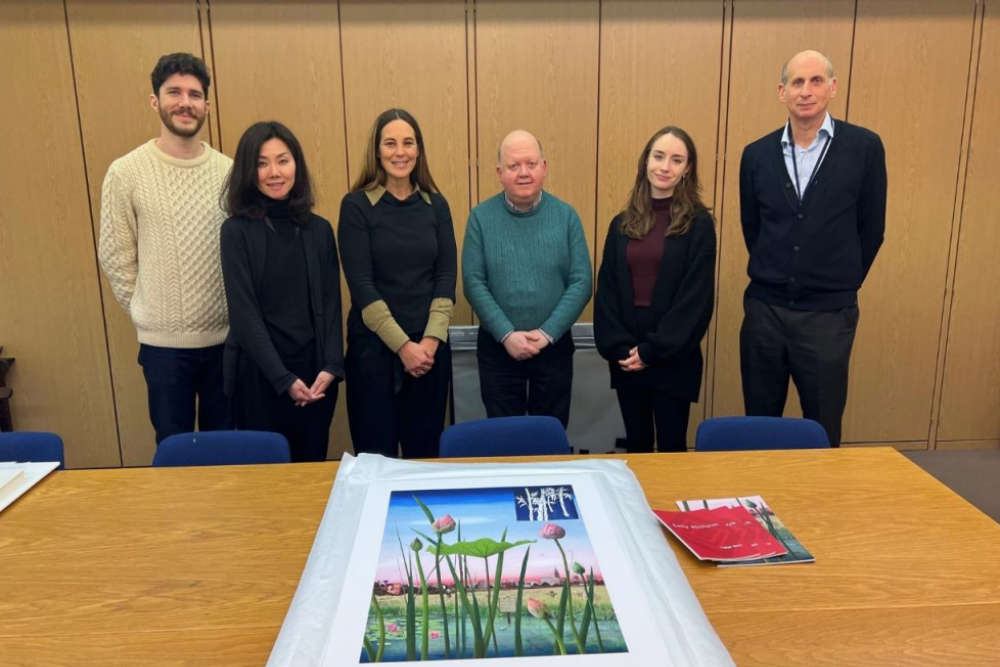

Jersey-born artist's work exhibited in the British Museum

Jersey-born artist's work exhibited in the British Museum

Jersey Hospice opens new chairty shop out east

Jersey Hospice opens new chairty shop out east

FIRST LOOK: New Parade Gardens playgrounds open two weeks early

FIRST LOOK: New Parade Gardens playgrounds open two weeks early

Bournemouth on the cards for 2026

Bournemouth on the cards for 2026