A tax cut is being offered to homeowners who rent out a spare room.

The government's Rent A Room Scheme has been set up to help address Jersey's housing shortage by incentivising islanders with a tax break.

Live-in landlords will qualify providing:

- More than £10,000 is not earned by renting the room;

- A family member is not renting the room;

- The room is in the homeowner’s main residence and is not a self-contained unit;

- The lodger is over 18 or placed in the room by an appropriate organisation if they are under 18.

The 2021 census found around a quarter of households were 'under-occupied'.

Housing Minister Deputy David Warr is confident this scheme will lead to an increase in accommodation for people seeking somewhere for a short stay.

“That might be foreign language students, or workers in Jersey for short-term contracts, or Islanders who just need a bedroom. Whoever it is, they are likely to feel more welcome, and more in touch with Island life, if they’re staying in someone’s home.”

However, Deputy Sam Mézec from Reform Jersey says all it will do is give a tax cut to people already making money from renting out rooms in their homes.

He's also expressed concern it is being offered without any requirements to ensure the homes are safe to live in and that tenants/landlords are safe to live with.

"This move is poor value for money for taxpayers and has not been properly thought out by the government. This represents a £2,000 tax cut for people who already make money by renting out rooms in their homes, for doing nothing extra whatsoever.

A much better use of this money would have been to hold a publicity campaign informing landlords of their rights and responsibilities towards their tenants, to ensure that if they choose to rent rooms out, they are fully aware of their legal obligations and can keep themselves and their tenants safe"

The States rejected a proposed amendment from Reform last month which would have allowed landlords and tenants to check if the other party has a criminal record for sexual offences or domestic abuse.

Reform Deputy Rob Ward, who brought that safeguards amendment says, "This is not addressing the housing crisis faced by young people wanting to build a career on the island or for families struggling to find appropriate accommodation. It will provide a tax break for those offering accommodation for language students which must be questioned as a good use of Government money."

The split between working and non-working Jersey homeless is nearly 50/50

The split between working and non-working Jersey homeless is nearly 50/50

Carers offered free training sessions for dementia

Carers offered free training sessions for dementia

Firefighters save two islanders from serious St Peter car crash

Firefighters save two islanders from serious St Peter car crash

New Channel Islands catamaran tests well in choppy seas

New Channel Islands catamaran tests well in choppy seas

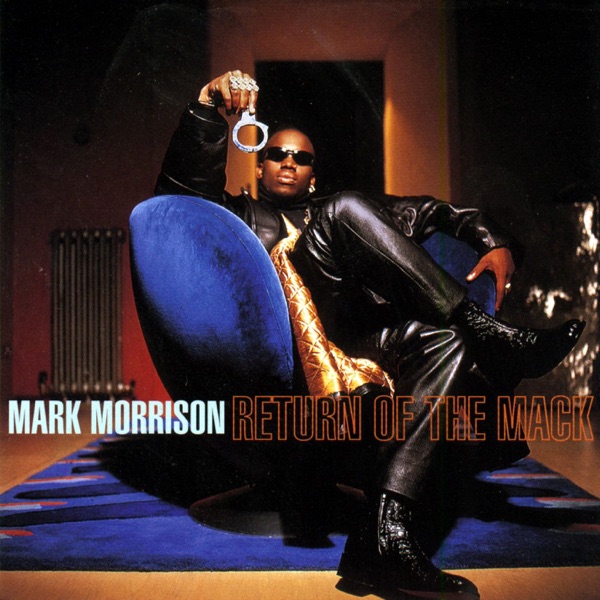

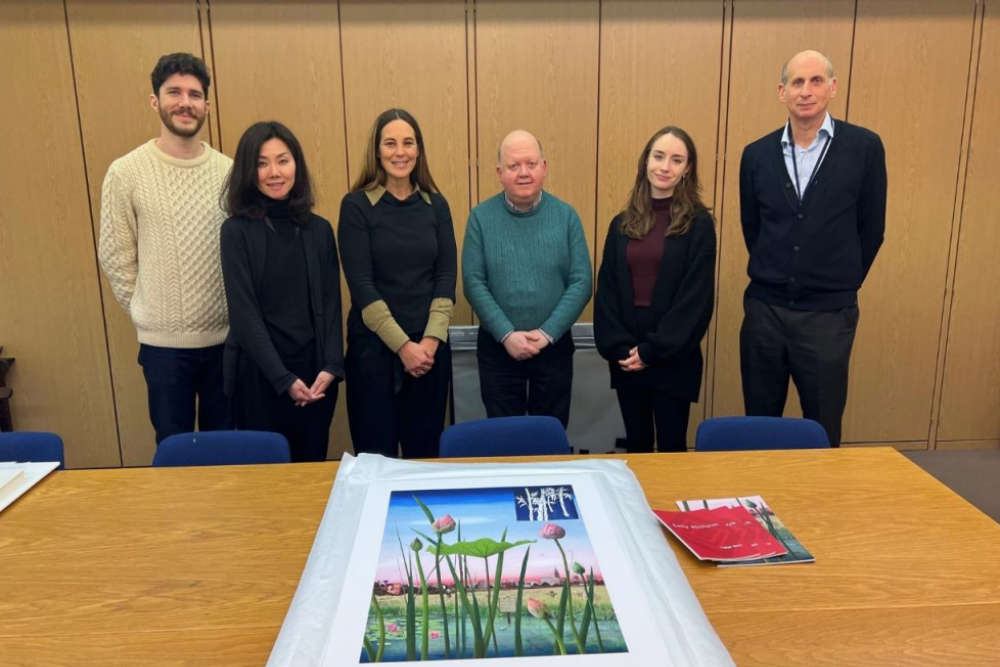

Jersey-born artist's work exhibited in the British Museum

Jersey-born artist's work exhibited in the British Museum

Jersey Hospice opens new chairty shop out east

Jersey Hospice opens new chairty shop out east

FIRST LOOK: New Parade Gardens playgrounds open two weeks early

FIRST LOOK: New Parade Gardens playgrounds open two weeks early

Bournemouth on the cards for 2026

Bournemouth on the cards for 2026